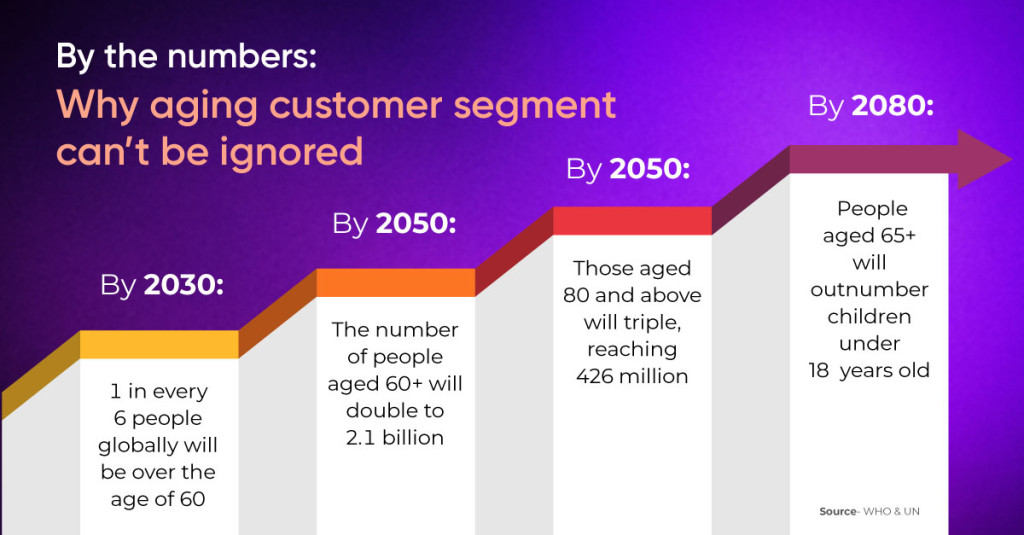

As people live longer and birth rates decline in many parts of the world, we’re witnessing a significant demographic shift. The global population is aging and this transformation is reshaping industries across the board, insurance included. In response, insurance technology solutions are playing a pivotal role in helping providers adapt to this shifting customer pool.

For insurers, this is a wake-up call. The demand for age-inclusive insurance products is set to rise sharply. From health coverage and life insurance to long-term care, annuities, and even travel policies, older adults are emerging as one of the most significant customer segments in the industry.

Digital convenience meets senior customer base

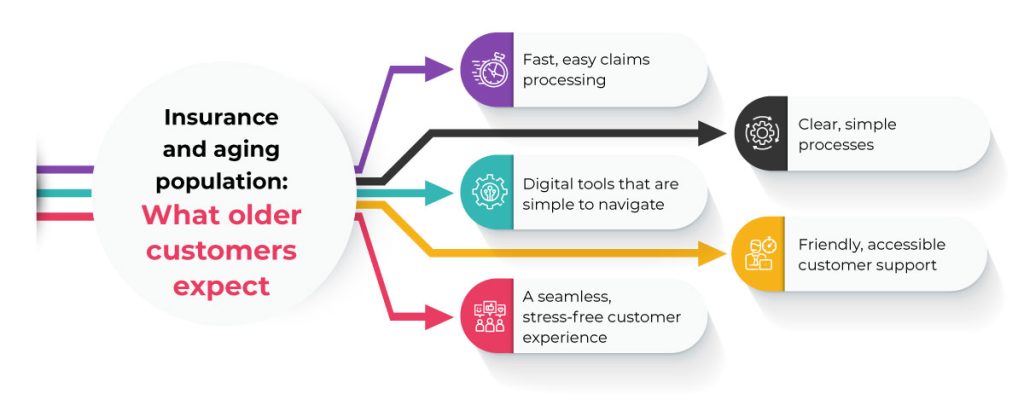

As older adults slowly emerge as one of the fastest-growing segments in the insurance market, it’s crucial to assess whether your insurance digital transformation journeys are truly inclusive for them. For aging policyholders who often deal with complex products such as long-term care, annuities, or supplemental health, digital touchpoints must be clear, supportive, and easy to navigate.

A digitally mature insurer will ensure every interaction, whether through apps, portals, or hybrid support channels, meets the needs of all customers, regardless of age or their digital confidence.

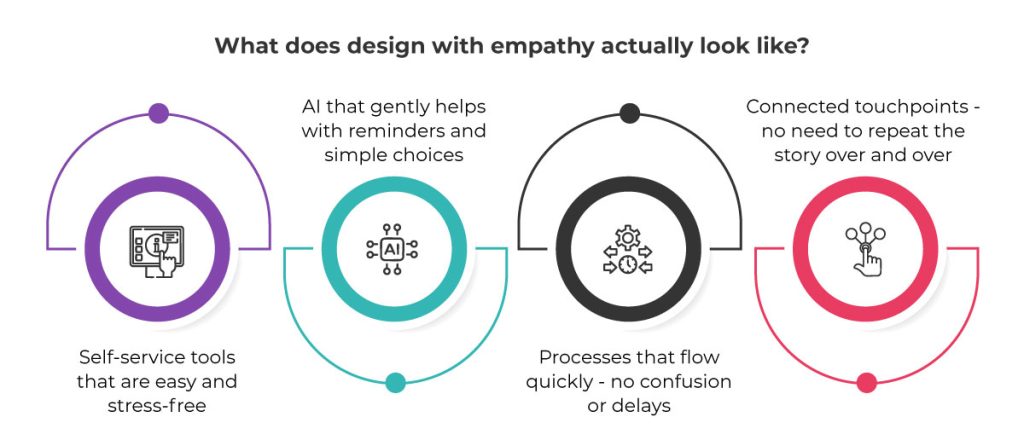

Insurance digital transformation: Designing with empathy

Consider a 72-year-old policyholder recovering from surgery and attempting to file a claim, or a retired couple reviewing the terms of a life insurance policy. These are the individuals who navigate your applications during vulnerable and emotionally taxing situations. In such moments, the need for clarity, simplicity, and empathy in their insurance experience becomes critically important.

This highlights the importance of embedding empathy-driven design into every layer of insurance IT services. Underwriting should adapt to changing needs. Claims should feel easy. And digital experiences must feel like they were made for older users. Digital claims processing, including automated first notification of loss (FNOL), should balance operational efficiency with emotional sensitivity. Blending intelligent automation with proactive human support can significantly enhance the overall experience.

Power your insurance with smarter, kinder technology

Success in this digital era isn’t about deploying the latest technologies it’s about using them in ways that are intuitive and inclusive

To do that, here’s what you can do:

- Automated underwriting and claims processing to reduce friction and improve turnaround times

- AI-driven risk analysis that adapts to nuanced health and lifestyle changes, enabling more personalized, fair, and profitable coverage

- Self-service journeys that truly empower users of all ages, especially those who prefer independence but may need a gentler interface

- A connected digital ecosystem that brings together partners, platforms, and customers, making the experience seamless across every touchpoint

In the coming years, differentiation won’t come from using the latest technology alone; it will come from technology that is accessible, empathetic, and frictionless. If you’re looking to bring that change, work with trusted insurance domain and insurance technology experts.

Aspire Systems can help you out. Our insurance IT services, delivered by certified domain experts, are designed to align with your business goals while ensuring no customer feels left behind.

- Insurance Automation Sweet Spot: When To Automate And When To Keep The Human Touch - August 26, 2025

- One Bug. One Bad Release. One Costly Mistake: Why New-Age Insurance Application Testing Matters - August 19, 2025

- The Grey Wave Is Here: Is Your Insurance Technology Solutions Inclusive Enough? - July 25, 2025

Write to Us

Write to Us