Data analytics in the insurance sector is creating a massive shift – defying traditional ways of working to unlock new business growth opportunities. Insurance companies, by nature of their business, gather humungous amounts of data regularly. This core nature of the industry and thirst to tap into new business opportunities have forced insurance companies across the globe to adopt newer and smarter ways to analyze this data to accelerate business outcomes. The need for faster data-driven decision making has led insurers to rely on data transformation services to handle critical data and analytic needs.

Insurance Data Analytics for a Proactive Business

Thanks to digital innovations powered by big data, predictive analytics and cognitive computing, insurers are moving towards a more proactive model of business. This reflects every day as accurate risk assessments and greater real-time business insights that prevent future losses.

This shift to a proactive business model powered by advanced analytics also means that insurance companies will be dealing with ever-growing banks of data.

This has made advanced data analytics a business imperative for insurance companies, with dedicated efforts to leverage services such as data discovery, data optimizer, customer 360°, and customer intelligence.

Companies that use customer analytics intensively are 23 times more likely to outperform competitors in acquiring new customers, and nine times more likely to surpass them in customer loyalty. (Source: McKinsey report, “Five Facts: How Customer Analytics Boosts Corporate Performance”)

Top Data Analytics Insurance Use Cases

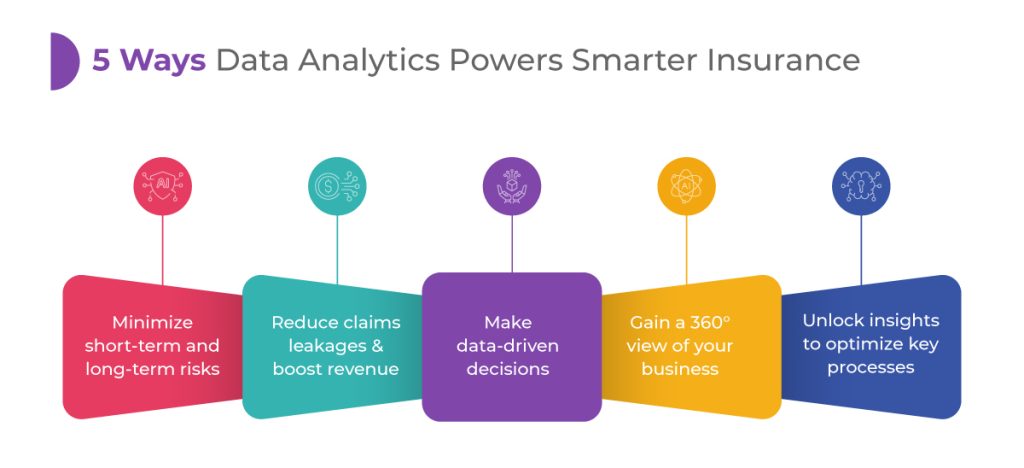

Undoubtedly, data has become the center of focus for the insurance industry that has tremendous power when unleashed rightly. Let’s look at some of the top uses cases and benefits, the insurance industry can reap from Data Analytics.

Claims processing: Data analytics plays a critical role in transforming claims processing by enabling intelligent automation across the entire claims lifecycle from FNOL to settlement. By analyzing data captured from multiple sources, including claims systems, telematics, and historical claims data, insurers can segment claims more effectively, prioritize high-risk cases, and support automated adjudication. Advanced analytics also provides actionable insights to detect potential fraud, improve decision accuracy, increase straight-through processing, and reduce turnaround times, resulting in more efficient operations and improved policyholder experience.

Fraud Detection: This is a core operational requirement in the insurance industry which directly impacts loss ratios, regulatory compliance, and customer trust. As claim volumes and data sources increase, traditional rule-based and manual review approaches are insufficient to identify sophisticated fraud patterns. Data analytics enables insurers to systematically analyze structured and unstructured data across policies, claims, payments, and customer interactions to detect anomalies and behavioral inconsistencies. Techniques such as predictive modeling, pattern recognition, and real-time analytics support early fraud identification, risk scoring, and prioritized investigations, allowing insurers to reduce financial leakage while maintaining efficient and accurate claims processing.

Read more: Enabling a smarter claims processing & fraud detection with RPA

Underwriting Automation: Underwriting automation plays a pivotal role in modern insurance operations by enabling faster, more consistent evaluation of risks across large volumes of applications. As risk profiles become more complex, relying solely on manual judgment limits scalability and increases the potential for errors. Data analytics is central to effective underwriting automation, as it transforms diverse data sets ranging from applicant and policy data to historical loss experience and third-party risk indicators into actionable insights. By leveraging analytical models and data-driven rules, insurers can automate risk classification, improve pricing accuracy, and ensure underwriting decisions are aligned with overall risk and profitability objectives.

Risk Assessment: Risk assessment is a foundational function in the insurance lifecycle, directly influencing key underwriting decisions, pricing accuracy, and portfolio stability. As the number of risk variables and data sources continue to grow, basic manual assessment approaches will no longer suffice to deliver consistent and timely outcomes. Data analytics enables insurers to evaluate risk more precisely by analyzing historical loss data, exposure patterns, behavioral indicators, and external risk factors. Through machine learning algorithms and advanced analytics, insurers can quantify risk levels, identify emerging trends, and support more informed, data-driven decisions that improve underwriting quality and long-term profitability.

Customized Policy Offerings: Customized policy offerings have become increasingly important as customers expect insurance products that align closely with their individual needs and risk profiles. Mass-market policy designs often fail to address varying coverage requirements and pricing sensitivities. Data analytics enables insurers to design personalized products by analyzing customer demographics, behavior patterns, risk exposure, and historical policy data. These insights support tailored coverage options, dynamic pricing, and targeted add-ons, allowing insurers to improve customer relevance, enhance satisfaction, and drive stronger retention while maintaining effective risk control.

Conclusion

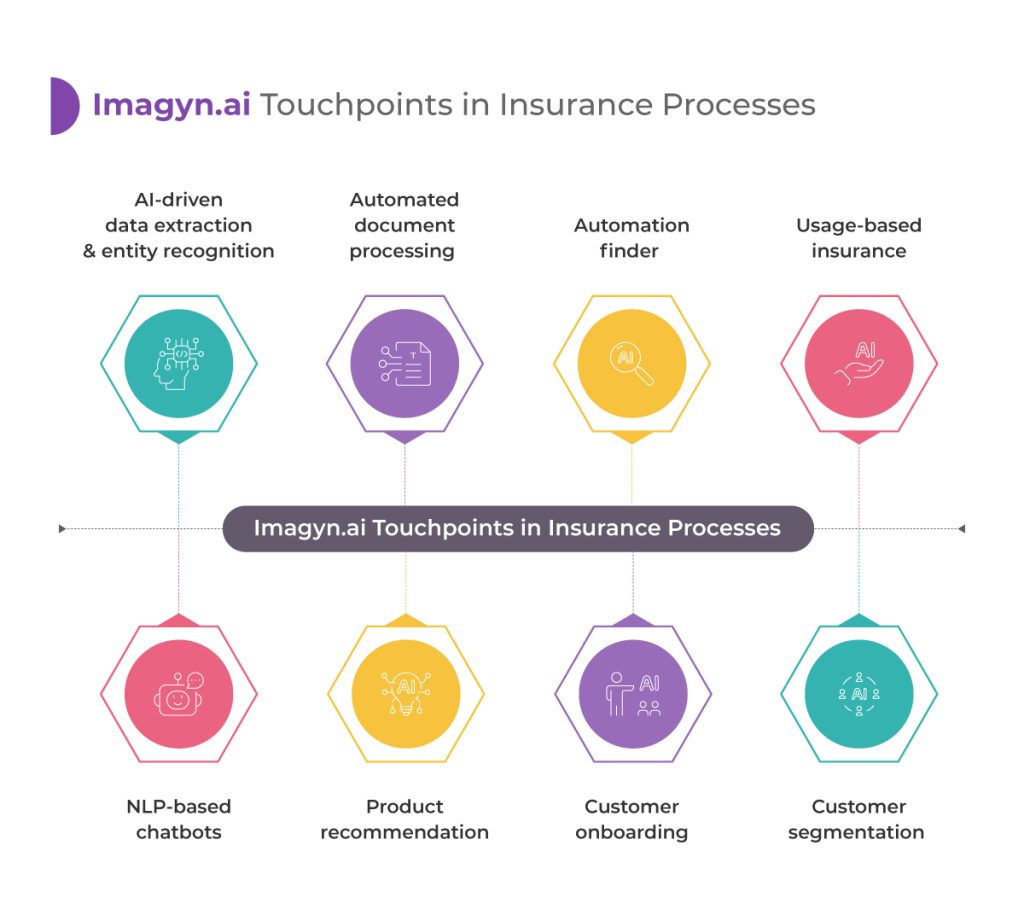

In a world where data is the new currency, insurers that unlock its power will lead the industry transformation. Advanced analytics isn’t just a tool, it’s the engine that enables faster, smarter decision-making across claims, underwriting, risk assessment, and customer experience. Frameworks like Imagyn.ai – Imagyn.ai, our home-grown AI/ML powered insurance data analytics framework, illustrate how purpose-built, AI-driven analytics can reshape insurance operations by integrating enterprise data management, predictive modeling, customer 360° insights, and real-time intelligence into a unified platform. This approach helps insurers boost operational efficiency, personalize offerings, and make proactive decisions with confidence. As data volumes grow and customer expectations rise, analytics anchored by flexible, scalable solutions like Imagyn.ai will remain the ultimate game-changer that drives growth, agility, and competitive advantage in insurance.

- The Rise and Rise of Insurance Data Analytics: The Ultimate Game-changer for Insurers - January 27, 2026

- Insurance Automation Sweet Spot: When To Automate And When To Keep The Human Touch - August 26, 2025

- One Bug. One Bad Release. One Costly Mistake: Why New-Age Insurance Application Testing Matters - August 19, 2025

Write to Us

Write to Us