Experience Next-generation Payment Solutions

Finastra Pay to Go is the more accessible and agile version of the renowned Global PAYPlus (GPP) known for its end-to-end payment processing capabilities that empower financial institutions of the largest scale around the globe. It offers the best of both worlds by bringing in the reliability and expertise of GPP with a focus on delivering essential payment functionalities in a ‘pay-as-you-go' model, allowing easy adaptability and scale when required.

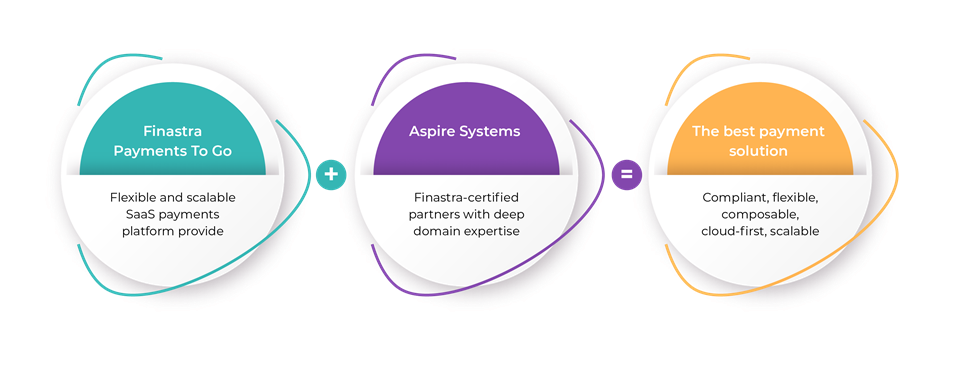

How can Aspire Systems help?

Partner with Aspire Systems for a transformative journey toward efficient, compliant and scalable digital payment solutions. Experience enhanced efficiency, expediated implementation, boosted operational excellence and reduced operational costs with Aspire’s close partnership with Finastra Pay 2 Go service, years of industry experience and certified banking experts.

Navigating the Digital Payments Landscape

Best in class Payments Hub

Embedded finance capability

Open banking capability

Real-time payments

MT to MX Conversion (ISO 20022 messaging standard)

Ethical Trading Initiative (ETI)

Local & international regulations compliance

New Payments Architecture

Framework for faster financial product release

Cloud-based payments

Payments Embedded to the core

PSD2

Navigating the Digital Payments Landscape - only text

With this approach Aspire, along with Finastra’s offerings, satiates the three main driving factors of today’s banking and financial sector.

Customer Expectations

Today’s consumer has evolved multifold demanding banks and financial institutions to go digital and offer hyper-personal banking and money management features served right from the banks.

Regulations

The never-ending saga of newer regulations and compliance standards both locally and internationally keeps every bank on their toes.

Collaborative offerings

The possibilities that 3rd party integrations enable has grown multitude in the finance sector that the availability and openness to collaborate has become a necessity.

Are you SEPA Instant ready?

Send and receive money across Europe in seconds with SEPA Instant. This new service will be mandatory starting January 19, 2025. Be prepared for faster payments in the European financial system. Aspire can help you implement SEPA Instant smoothly.

Pathway to Payments Digitization

Enable

Real-time Payments

Transform

MT to MX Conversion

Integrate

Embedded Finance, Open Banking

Manage

Support and update

Aspire’s Digital Payment Offerings

Digital Payment Transformation (core independent) Solution

Move to the latest payment ecosystem that is robust and complaint independent/embedded to the core banking system however required.

Digital Payment Implementation Solution

Implementing a robust and modern payments gateway with Finastra Payments To Go (powered by Globay PAYPlus)

Managed Payment Services

Payments implemented and managed for reliable, efficient and hiccup-free operations all time.

Aspire’s Accolades

25+

Certified Payment Experts

15+

Payment Transformations

150

Banking and Finance Clients

350+

Banking and Finance Domain Experts

50+

Digital Implementations

10

Years of Domain Expertise

Aspire’s Banking & Payments Clientele

Evolve Your Payments with Finastra Pay to Go: The Agile & Accessible Version of Global PAYPlus