Insurance Data Analytics with Imagyn.ai: Use Data to your Advantage

Insurers such as you generate massive data volumes, but it does not result in business intelligence unless it is leveraged by modern analytics. To take your insurance data journey to be insightful, you need enterprise data management & reporting, use of Big Data engineering & predictive analytics in insurance. Our domain-focused AI and analytics solutions for insurance – Imagyn.ai - has been built to rehaul your data infrastructure to identify new growth opportunities, enhance CX, & boost operational efficiency. A team of insurance data analytics experts have built it to guide transition to a cutting-edge insurance data platform

Imagyn.ai Touchpoints In Insurance Processes

AI-driven Data Extraction & Entity Recognition

Al-led algorithms for entity recognition from emails and customer sentiments on claim requests, enquiries etc.

Automated Document Processing

Detect, classify and extract data from documents, images & applying image-based ML models.

Automation Finder

Analyze statistics about a process such as underwriting & predicting the classification of a new process.

NLP-based Chatbots

NLP-based chatbots accepting customer queries and responding with product offering, quote generation etc.

Customer Segmentation

Personalize offerings, predict churns, etc., with customer 360° data analytics. Enhance underwriting with financial, medical, and lifestyle risk assessment.

Customer Onboarding

Hyper-automated customer onboarding process using Al, quote generation & underwriting powered by AI.

Product Recommendation

Apply machine learning algorithms to recommend tailored insurance products matching your customer needs.

Usage-based Insurance

Utilize customer behavior data such as lifestyle habits, driving pattern, etc. to calculate usage-based premiums.

How Imagyn.ai Helps Insurers

Want to truly “get” your customers? Imagyn.ai, our home-grown AI/ML powered insurance data analytics framework, is purpose-built to analyze behavioral patterns from every customer touchpoint, delivering strategic insights that empower decision-makers like you. It transforms raw data into valuable intelligence, enabling deeper customer engagement. Designed for maximum flexibility, Imagyn.ai's loosely coupled architecture seamlessly adapts to any insurer's unique needs.

Data Discovery

Get a deep dive into insurance systems, data journeys, technology stack to assess the feasibility and ROI of an implementation. Discover data and ways to use it throughout customer journey.

Data Optimizer

Data ingestion, data provisioning & data standardization to store a centralized version of each customer’s record across all insurance services. Cuts inaccuracies & saves processing time.

Customer 360°

Enabling insurers to improve customer data by monitoring, managing, and storing data into a customer hub. Ensures easy access of data by internal teams and better transparency.

Customer Intelligence

Enabling insurers to leverage actionable insights for making key decisions on product offerings, business models, and cross-sell/upsell campaigns based on customer preference & usage.

A Million Records in a Minute – Imagyn.ai transformation

Case StudyAspire Systems helps leading insurer wield the power of insurance data analytics – Check out how we helped a leading insurer, struggling with legacy systems and loss of customer base, get onboard a 1000x faster platform and see 4.6% increase in customer

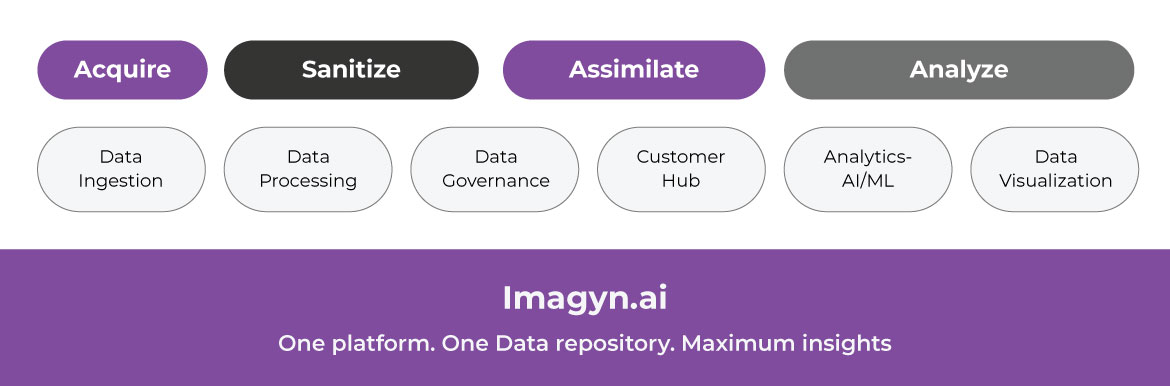

Imagyn.ai Framework

Data & Analytics Services

We provide end-to-end data transformation services, helping insurers achieve higher data maturity capabilities.

Insurance Data Management

- Data integration services

- Data modelling

- Data testing

- Data engineering

- Data security governance

Business Intelligence In Insurance

- Reporting & analysis

- Data marts

- Multi-dimensional modelling

- Descriptive analytics

- Trend analytics

Big Data In Insurance

- Data Lake Implementation

- Recommendation engine to cross-sell, up-sell

- Text analytics, NLP

Predictive Analytics In Insurance

- Statistical modelling & correlation analysis

- Machine learning & deep learning

- Predictive & perspective modelling

Trusted by Today's Top Brands

FAQs

How does Aspire Systems’ Insurance Data Analytics & AI Framework drive business value for insurers?

What makes Aspire Systems’ AI and analytics approach different for the insurance industry?

What should insurers look for in a partner for data-driven transformation?

Don’t ignore what is in front of your eyes. Leverage insurance data now!