There’s a quiet fear that tends to surface often when the term “Insurance automation” is mentioned in the insurance industry. This narrative, while pervasive across industries, fundamentally misunderstands the transformative power of AI. Its objective is not to replace human capital, rather to redefine and enhance work efficiency.

This isn’t about speed. It’s about…

Yes, AI is faster. It processes data instantly, flags real-time risks, and handles high volumes in no time. But speed isn’t the real win.

The true advantage of AI in insurance industry is its capability to liberate your workforce from the relentless burden of mundane, repetitive, and cognitively unstimulating tasks. It also enhances your risk assessments to unprecedented levels of accuracy and time efficiency. This newfound freedom allows your employees to dedicate their time and expertise on high-order tasks. The real value is the space it creates for underwriters to think more strategically, for adjusters to manage complex claims with care, and service teams to focus on meaningful interactions, not just volume.

In an industry such as insurance where the human-touch comes as true nature, technology, when implemented thoughtfully, helps your workforce lead with intention.

Where’s the sweet spot in your automation journey?

If you are an insurer just beginning to consider automation, here’s a basic 101 for you to go by on business areas you can automate:

| Automate when… | Keep it human when… |

| The work is repetitive, rule-based, and high-volume. | The situation is unique, emotional, or complex. |

| Decisions are clear-cut and based on simple data. | Decisions need nuance, experience, or emotional intelligence. |

| Precision and consistency are more important than creativity. | Trust, negotiation, and relationships are on the line. |

| You need to scale quickly and handle more volume. | You need flexibility, empathy, and judgment. |

In short, automate the predictable, keep humans for the unpredictable if you are just starting out.

Here’s where a lot of insurers are using automation in insurance to strike the perfect balance

1) Application Submission

Manual paperwork has been a friction point for both internal teams and policyholders. By digitizing submission workflows through intuitive web portals and intelligent document processing tools, insurers can streamline data capture, reduce errors, and minimize the inefficiencies of back-and-forth communication.

2) Underwriting process

By leveraging advanced analytics, AI-driven risk checks, and intelligent automation that powers an Underwriting Decision Engine behind the scenes, insurers can accelerate underwriting processes while maintaining accuracy, compliance, and a personalized touch.

Success story

European P&C insurer cuts underwriting time by 70% with automation framework InsurEdge

3) Claims processing

With intelligent automation in place, insurers can rapidly triage claims, flag potential fraud, and fast-track straightforward cases. This allows frontline teams to focus their expertise where it matters most.

Success story

Claims process revamp gets insurer 30% more cost savings and revenue

4) Policy management

Updating policies and processing reports shouldn’t feel like a paperwork marathon. Automation helps you keep things moving behind the scenes and makes sure customers stay in the loop with fast, automated clear communication that doesn’t feel like it was written by a robot.

Success story

India’s top life insurer makes complex decision in seconds with the help of 90% automation

5) Customer service

Customers prefer immediate response no matter the time of day. With AI chatbots, intuitive self-service portals, and CX accelerators such as ACIA, you can be there 24/7, without burning out your team. Plus, smart dashboards give customers what they need, without making them dig for it.

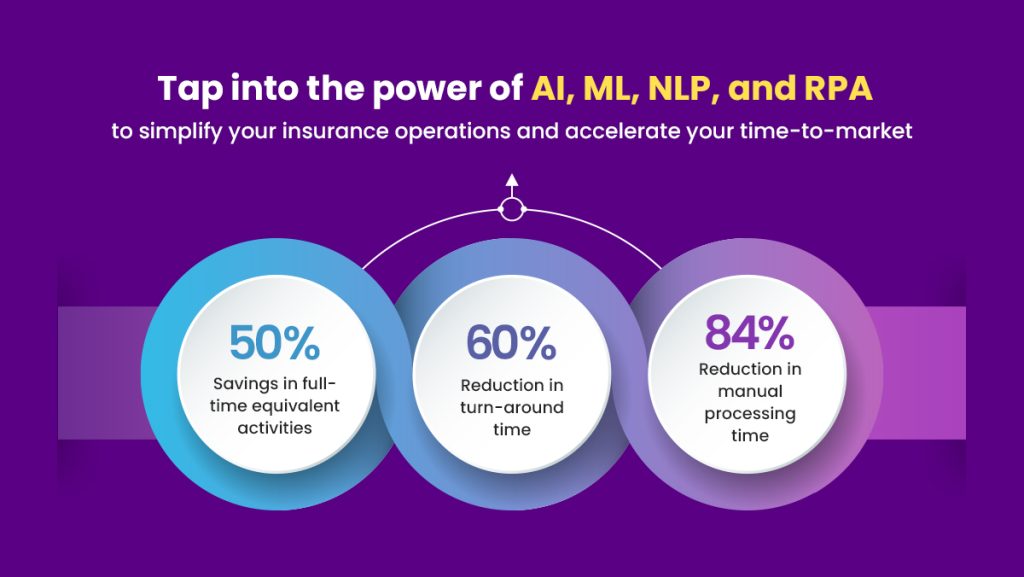

Choose your insurance automation partner wisely

Choosing the right partner is the first step toward meaningful insurance automation. The right partner can help you automate the repetitive, empower your teams for future scaling up, and elevate the customer experience to improve business outcomes right away. At Aspire Systems, we bring deep insurance domain expertise, intelligent automation capabilities, and automation experience to help you strike this perfect balance.

Most asked questions

Insurance automation works best when applied across key areas such as underwriting, claims, and customer service. By automating repetitive tasks and streamlining workflows, companies can reduce costs and speed up processes. Intelligent automation can power decisions, fraud detection. This balanced approach drives real ROI and supports long-term growth.

To scale intelligent automation, companies need skilled teams that blend tech know-how with insurance expertise. Leaders should promote ongoing learning, foster collaboration between IT and business teams, and support a culture that embraces AI and automation without losing the human touch. This ensures smooth adoption and sustained success.

AI in insurance industry helps improve risk decisions and personalize customer service by analyzing data quickly and accurately. When combined with strong security practices and compliance checks, automation in insurance ensures sensitive information stays safe while enhancing customer engagement and operational efficiency.

- The Rise and Rise of Insurance Data Analytics: The Ultimate Game-changer for Insurers - January 27, 2026

- Insurance Automation Sweet Spot: When To Automate And When To Keep The Human Touch - August 26, 2025

- One Bug. One Bad Release. One Costly Mistake: Why New-Age Insurance Application Testing Matters - August 19, 2025

Write to Us

Write to Us