The Importance of Scaling AI in Lending

The initial promise of AI-powered lending solutions is transforming into real-world value for financial institutions scaling these tools across their core operations. This article offers a data-driven roadmap for successfully scaling AI credit solutions, exploring key benefits, challenges, and strategic steps for digital transformation in credit risk management, focusing on AI-powered lending and machine learning in finance.

Why Scale AI?

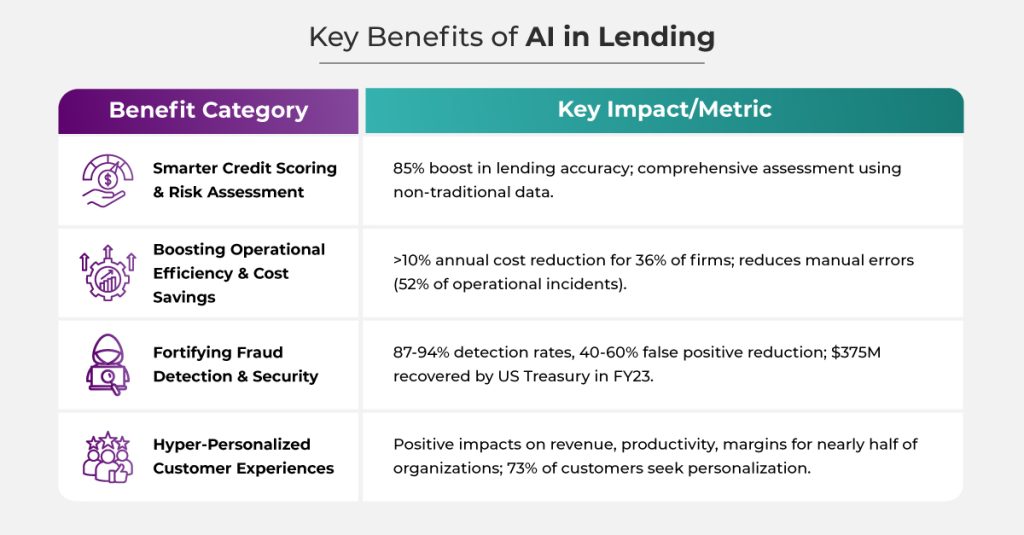

Scaling AI in lending delivers profound, measurable value across efficiency, risk, customer experience, and compliance. Here are some of those:

- Enhanced Efficiency & Cost Reduction

AI significantly boosts operational efficiency and cuts costs by automating repetitive tasks prone to human error. A 2023 NVIDIA survey found 36% of financial services professionals reported AI decreased annual costs by over 10%. This is crucial, as human error causes 52% of operational incidents. For example, generative AI tools like Bloom and Jasper can reduce document processing time from 90 minutes to under 30 minutes in loan origination, freeing human employees for more complex, value-added work. Platforms like Upstart and Zest AI leverage AI for automated loan underwriting, demonstrating significant efficiency gains. These AI for loan origination solutions streamline the lending process, reducing manual effort and improving turnaround times.

- Superior Risk Management & Fraud Detection

AI is a powerful weapon against financial fraud, which accounts for approximately $42 billion in annual losses globally. AI-powered systems, using algorithms like anomaly detection and machine learning models such as Random Forest and Gradient Boosting, achieve detection rates of 87-94% while reducing false positives by 40-60% compared to traditional methods. The U.S. Department of the Treasury recovered over $375 million in fiscal year 2023 thanks to AI-enhanced fraud detection. AI is particularly effective against check fraud (a 385% increase since COVID-19) and money laundering (estimated $2 trillion annually). Notably, 84% of banks use AI/ML models for fraud detection, making it the most common use case for credit risk AI and algorithmic lending.

- Personalized Customer Experience & Growth

AI-driven personalization transforms customer relationships by incorporating detailed data on preferences and behavior for individualized experiences. Nearly half of organizations using AI for personalization report positive impacts on revenue, productivity, and margins. Furthermore, 86% of companies see measurable business improvements from personalization, with 73% of customers actively seeking these tailored experiences. AI creates comprehensive 360-degree customer profiles, improving retention and revenue. For instance, 76% of fintech apps now use AI for tailored user interfaces, and AI-powered

- Regulatory Compliance & Adaptability

AI streamlines compliance reporting and improves audit trails through data-driven decision-making. It helps institutions adhere to complex regulations, ensuring fair lending and ethical AI use.

Key Benefits of AI in Lending

Navigating the Hurdles: Common Challenges in AI Scaling

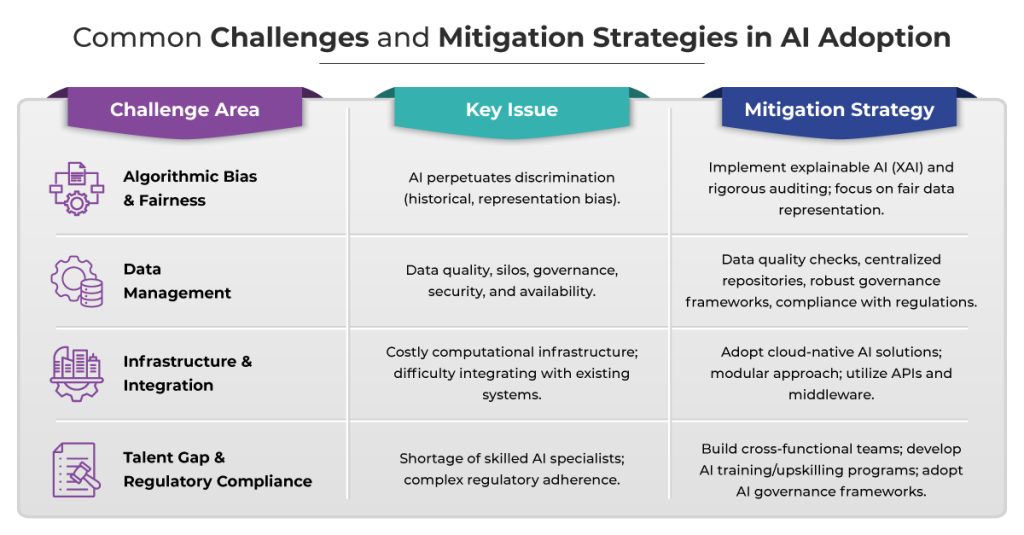

Despite its transformative potential, AI adoption in lending presents complexities that financial institutions must navigate for successful and responsible implementation.

- Data Silos & Quality Issues

AI model effectiveness hinges on data quality; inaccurate or inconsistent data leads to poor performance. Data silos, where information is scattered across departments, hinder effective AI utilization. Managing data privacy, security, and GDPR compliance also grows complex with increasing data volumes.

- Talent Gaps & Organizational Resistance

A significant challenge is acquiring and retaining qualified AI specialists due to high market demand. This necessitates training existing personnel and fostering broader AI literacy. Organizational resistance to change can also impede adoption.

- Technology Infrastructure & Integration Complexities

Scaling AI requires expensive computational infrastructure like GPUs and TPUs. Integrating new AI models with existing IT systems and ensuring consistent data transmission is challenging, especially with legacy systems not designed for AI.

- Model Governance, Explainability & Bias

AI in lending risks perpetuating discrimination through historical bias (learning from past discriminatory data) and representation bias (insufficiently diverse training data). Examples include AI flagging irregular income patterns as ‘high risk’ or giving higher risk scores to minority applicants with similar financial backgrounds. This demands explainable AI (XAI) and rigorous auditing to ensure fairness and compliance.

Strategic Roadmap: A Phased Approach to Scaling AI Credit Solutions

For financial institutions to harness AI’s full potential while mitigating risks, a strategic approach is essential.

1. Establish a Robust Data Foundation

Implement rigorous data quality checks, invest in cleaning tools, and define clear data governance policies. Break down data silos by creating centralized data repositories (data lakes/warehouses) and integrating platforms to ensure comprehensive, consistent training data.

2. Build a Scalable Technology Stack

Leverage cloud-native AI solutions for computational power and scalability. Implement MLOps frameworks to automate model retraining and deployment, streamlining updates and efficient model deployment.

3. Cultivate AI-Ready Talent & Culture

Build cross-functional AI teams with data scientists, engineers, legal, ethics, and business experts. Develop AI training and upskilling programs for existing personnel to bridge the talent gap and foster AI literacy.

4. Implement Comprehensive Governance & Monitoring

Continuously track model performance to identify issues, adopting a ‘measure, iterate, govern’ philosophy. Establish clear policies for model development, deployment, and monitoring, along with explainability tools, for ethical AI and regulatory compliance.

5. Adopt a Phased Rollout Strategy

Start with high-impact, low-complexity areas to build credibility and momentum. This allows for iterative learning and expansion, ensuring AI supports human capabilities.

6. Measuring Success & Continuous Optimization

Measuring the impact of AI initiatives is crucial for demonstrating ROI and guiding future development. Some of the measurement parameters are;

- Key Performance Indicators (KPIs)

Measure success using KPIs like loan approval rates, default rates, processing time, cost per loan, customer satisfaction (NPS), and fraud detection rates. These metrics demonstrate AI’s contribution to business objectives.

- Iterative Learning & Feedback Loops

Continuous optimization involves regular model retraining with new data, A/B testing, and incorporating feedback from users. This ensures AI models remain accurate, relevant, and aligned with evolving business needs.

Conclusion: The Future of Lending is Scaled AI

AI is transforming lending, offering precision, efficiency, and personalized customer engagement. Its benefits are profound, from boosting accuracy and cutting costs to fortifying fraud defenses. Navigating challenges like bias and data management requires proactive, strategic responses. Successful AI integration hinges on responsible innovation, robust data governance, scalable MLOps, and collaborative culture.

- Beyond Pilot: Scaling AI Credit Solutions Across Your Lending Operations - October 23, 2025

- Top 5 AI Banking Trends: What You Need to Know for 2025 and Beyond - October 23, 2025

- Choosing the Right Digital Payment Solution for Your Banking Needs- A Comprehensive Comparison - August 21, 2025

Write to Us

Write to Us